Federal Tax Brackets 2025 Standard Deduction

Federal Tax Brackets 2025 Standard Deduction. The brackets and the deductions (standard and itemized) are the two values. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

For 2025, the standard deduction is $14,600 for individuals and $29,200 for married couples filing jointly. 22% on income between $47,150 and $100,525.

Federal Tax Standard Deduction 2025 Sandi Cordelie, Tax brackets for income earned in 2025. Other annual tax adjustments for taxes filed in 2025.

Us Tax Brackets 2025 Miran, The standard deduction is bigger for taxpayers who are at. For married couples filing jointly, the standard deduction will increase from $25,900 to $27,700 in 2025.

Brackets 2025 Irs Ivett Ofilia, The brackets and the deductions (standard and itemized) are the two values. In 2025 and 2025, there are seven federal income tax rates and brackets:

2025 Irs Tax Brackets And Standard Deduction Felipa Abigael, Effective top marginal rate on capital gains income. 2025 2025 estate and trust tax brackets.

2025 Tax Brackets For Single Filers Pippa Chrissie, The brackets and the deductions (standard and itemized) are the two values. 22% on income between $47,150 and $100,525.

2025 Tax Updates Irs Cherie Fernande, The 2025 standard deduction for tax returns filed in 2025 is $13,850 for single. 2025 2025 estate and trust tax brackets.

What Are The Irs Tax Brackets For 2025 Hildy Joletta, 22% on income between $47,150 and $100,525. Tax brackets for income earned in 2025.

2025 Standard Deduction Over 65 Tax Brackets Lilas Carmelle, That’s a bump up of $1,800. In 2025 and 2025, there are seven federal income tax rates and brackets:

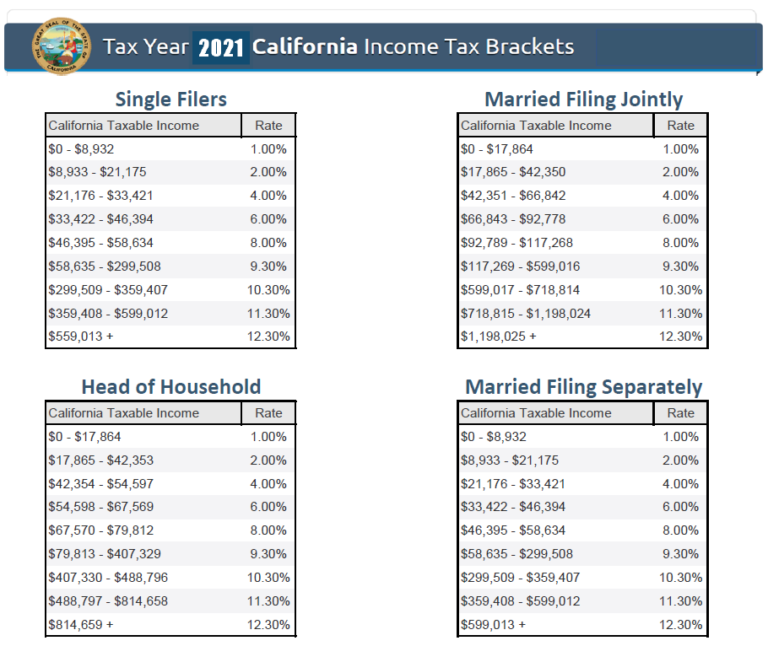

California State Tax Brackets 2025 Estele Tamarah, Standard deduction of rs 50,000 from salary and pension income and section 80ccd. The highest earners fall into the 37% range, while those who earn the least are in.

2025 Federal Tax Brackets Married Joint Gussy Jennine, If you look at the tax brackets for tax year 2025, you'll see that couples filing jointly get taxed 10% on the first $22,000 of their taxable income —. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;